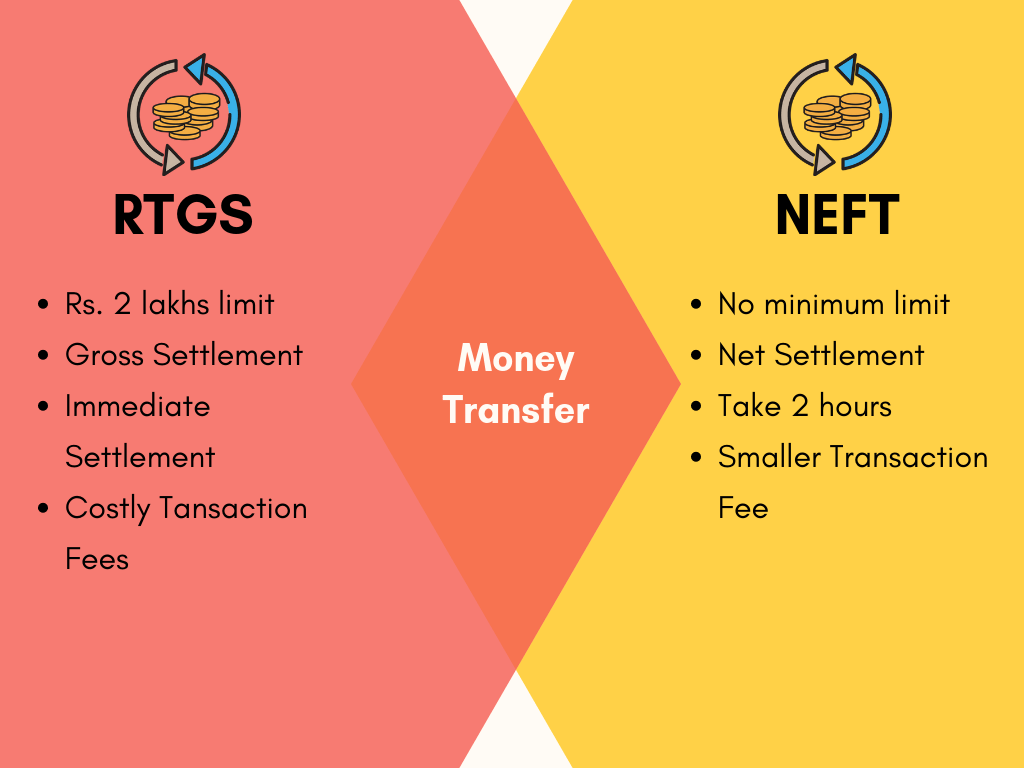

RTGS Vs. NEFT: Basic Differences to Know

The primary difference among these two terms are: Difference between rtgs and neft

- RTGS represents the large value transactions while there is no minimum limit for NEFT. RTGS is the real-time gross settlement, whereas NEFT is the national electronic funds transfer. They both are the types of electronic payment systems and allow individual funds transfer between banks. The Reserve Bank of India manages both these systems. It is appropriate only for money transfers within the country.

- Under RTGS, the fund’s transmission always takes place on a real-time basis, or we can say that at the time the request is received. Therefore, it is considered one of the fastest interbank money transfer capacities accessible through banking channels in India. The recipient bank has to credit the receiver’s account within 30 minutes of getting the fund’s transfer message. Conversely, NEFT functions on a postponed settlement basis. Fund transfer under NEFT will permanently be settled in batches instead of the real-time settlement process in RTGS. The batches will be settled in hourly time slots.

Timing differences

- All those Customers who possess savings or current accounts are entitled to avail of NEFT/ RTGS service. But Individuals who do not keep any bank account can also credit cash at the NEFT-enabled branches. Though, such cash transmittals will be limited to a maximum of 50,000 per transaction. The RTGS window will be available from 8 am to 4.30 pm on weekdays and working Saturdays. For NEFT, presently, there are a total of twelve settlements from 8 am to 7 pm. Though, the timings that the banks follow may differ depending on the customer timings of the bank branches.

- Online RTGS is available only within the mentioned cut-off time; otherwise, the funds will be transferred to the beneficiary bank on the next working day.

Difference in amount

- The facility of RTGS is meant for large value transactions and retail customers. The minimum amount forwarded through RTGS is two lakhs. On the other hand, there is no minimum amount for funds remitted via NEFT. If the electronic RTGS transactions for any reason, such as when the account does not exist or is frozen, it won’t be possible to credit the funds to the recipient customer’s account. The money will be credited into the sender’s account. The funds will be repaid to the originating bank in one hour or before the end of the RTGS business day.

Also read: Difference between resistance and resistivity

- For NEFT dealings, the destination banks must return the fund to the originating branch within two hours. NEFT charges cannot exceed 25 rupees per transaction, while RTGS charges are 55. The charges are usually lesser for internet banking.

In the case of RTGS, since all the transactions happen in real-time and the fund payment takes place in the books of the RBI, the payments are final and irreversible in any case. On the other hand, there is no facility for giving stop payment orders in the case of NEFT if the bank has initiated the transaction.

llgrpe